Here Are Some Of The Reasons Why An Organization Could Employ An External Cfo:

Present growth includes new products and expansion to new markets. An Outsourced CFO could have prior experience with similar markets, products, or industries and can provide guidance on strategy. Outsourced CFOs can assist in the management of costs, risk analysis, and maximising profits. A CFO who has been outsourced has probably dealt in similar situations before and knows how to plan and implement lasting, long-term improvements.

Capital raising for debt and equity. A consultant can help you in raising capital. Maximize margins with an analysis of the current pricing and cost arrangements. Your CFO can identify possible improvements and help with execution. Have a look a this outsourced cfo firm for information.

Consulting And Advising On Strategies On A Part-Time Base.

Scaling up the system to handle growth and added complexity. A new or better system will be needed. When a full-time CFO cannot be replaced or is currently being placed in place for the first in a long time, an interim CFO might be required. Temporary interim CFOs are one who is responsible for the financial strategy of an organization that is in need of CFO. Consultation with an existing or a new CFO, they can consult with an existing or new. A few organizations might have an internal CFO. But, that CFO might not have the expertise needed to solve specific issues or meet certain objectives (such such as designing systems or raising capital). An Outsourced CFO may consult with or advise the existing CFO to elevate the performance of their financial team, improve overall financial strategy, and transfer valuable skills.

A Financial Forecast Is Provided.

Forecasts are essential for many reasons. These include budgeting and raising capital, studying the financial health of your company and growth projections, restructuring , and other business objectives. An experienced Outsourced Chief Financial Officer has vast experience in forecasting and will provide a detailed forecast, in line with your long-term goals.

What are the responsibilities of a Controller/CPA/CFO?

The Outsourced Controller keeps accurate financial records, while a CPA or accountant ensures taxes and finances are in compliance, but a CFO provides financial strategy with insight, direction and action that is geared toward the future. Check out this "outsourced cfo firms" for more info.

Why Would You Opt For An Outsourced Cfo Rather Than An In-House One?

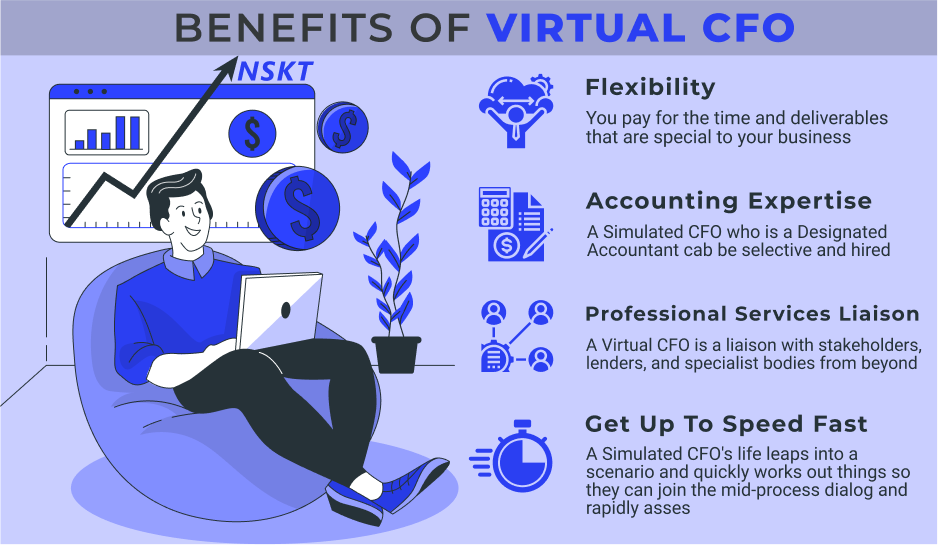

Each company could benefit from the knowledge, high-level strategy and operation fine-tuning provided by a CFO. However many companies aren't capable of hiring a full-time CFO. In-house employees typically earn a salary each year, and benefits. This is particularly true when considering annual raises. A lot of companies have to sacrifice their experience to hire an inexpensive CFO. The cost of hiring an outsourced CFO is cheaper because you're paying only for the amount of time you'll need. For a similar monthly cost (or less) and without any benefits or annual raises hiring an outsourced CFO with a lot of knowledge. Partner with a CFO that has expertise in solving specific issues. Outsourced CFOs have broad business, project, and industry experience. Outsourced CFOs have been in similar businesses before and have the expertise to help you achieve your objectives. The most effective Outsourced CFOs have access all the accounting and finance talent which allows them to construct teams for clients to accomplish their goals. One of the most significant advantages of an Outsourced Chief Financial Officer is the capability to form teams with a wide range of capabilities and industry experience. In some instances it is possible to do this less expensive than the costs of a full-time CFO.